WhatsApp)

WhatsApp)

Peruvian company, the tax rate is reduced to 5% if the transfer is made within the local stock exchange. Peruvian mining burden Mining producers are required to pay some sort of tax, unique to the sector, such as the Modified Mining Royalty (MMR), Special Mining Tax (SMT) or Special Mining .

Walls from red and grey lime stone in old,limestone mine Great America, Czech republic with dusty road Limestone Mining Conveyors. Conveyors at a Kentucky USA limestone quarry mining operation An old abandoned mine in the mountain. Mining rocks. Open cast mining air view. View in a open cast mining hole at northern Hesse, Germany.

rate of royalty on mining of limestone in indonesia Online Service report of the study group to review the rates of royalty and dead rent domestic and international, for attracting investment into the mining .

Mineral tax compensates the province for the commercial use and depletion of coal and mineral resources. In some cases, the tax revenue is shared with First Nation communities that have a revenue sharing agreement with the province.. Mine operators in B.C. must self-assess and pay Mineral Tax unless they qualify for an exemption or have only removed non-taxable resources.

Nov 19, 2018· The AAR clarified the ambiguity that persisted over the liability of the tax payment with respect to the royalty paid to secure mining license from the State Government. The issue arose as whether such amount was taxable in the hands of the licensees and in such case the rates .

Royalty: Apart from paying corporate tax to the Federal government, mine operators also pay value-based royalty to the State where their mining operation is located. Royalty rate in general is 5 % of the value of the mineral extracted but may vary depending on the mineral commodity, and as assessed by each of the individual States.

It applies one of three royalty rates depending on the form in which the mineral is sold (ore, concentrate or final form), and the extent to which it is processed. Specific rate royalties, calculated at a rate per tonne of production, generally apply under the Mining Regulations 1981 to low value construction and industrial minerals.

Valuation of Aggregate Operations for Banking Purposes (Sand and Gravel and Crushed Stone) Aggregate consists of sand and gravel and crushed stone. The principal consumers of sand and gravel and crushed stone materials are the highway and building construction industries. The principal construction uses include:

The rate of royalty is dependent on the mineral being extracted and is generally utilised for low value to volume minerals such as gypsum limestone, and clays. Ad valorem royalty - Ad valorem royalty is applied to high value to volume minerals. The base rate applicable for .

circular for rate of royalty for mining limestone – About us; Mining Equipment . 2002 · I have found no royalty rates differing by type of quarry in regard to being an inland . rock or gravel Shale . The rate of royalty . »More detailed

circular for rate of royalty for mining limestone. The rate of royalty used ;,circular for rate of royalty for mining limestone,Get A Free Quote mining aggregate royalty rates casaferrarieu Silica sand processing plant,gravel royalty rates in south,Energy,- mining aggregate royalty rates,Who can tell me about state and/or federal revenues and,Get A Free Quote.

The government of Indonesia plans to raise royalties for coal mining companies that hold a Mining Business Permit (Izin Usaha Pertambangan, abbreviated IUP) by revising Government Regulation No. 9 - 2012 on Tariff and Types of Non-Tax Revenue in a move to generate more state income. R. Sukhyar ...

Royalty is vital concern not only to the State Government, but also to the Mining Industry. This publication also covers the historical developments in the rates of royalty and mineralwise royalty collected by States in a tabular form. Royalty regime in important countries of the world has been discussed to have a

the mining royalty rate is not one fi xed tax rate according to type of mineral ... PwC Corporate income taxes, mining royalties and other mining taxes—2012 update 5 Indonesia has tax incentives for specifi c mining activities such as basic iron and steel manufacturing, gold and silver processing, certain brass, aluminium, zinc and ...

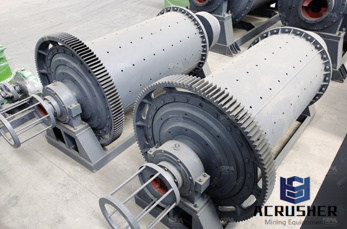

Circular For Rate Of Royalty For Mining Limestone Prompt : Caesar is a famous mining equipment manufacturer well-known both at home and abroad, major in producing stone crushing equipment, mineral separation equipment, limestone grinding equipment, etc.

RESPEC developed a detailed valuation of a Greenfield limestone mine that Sterling Materials had permitted in Gallatin County, Kentucky. The proposed underground Greenfield limestone mine included primary crushing and screening operations underground with the secondary screening and stockpiling located on the surface. The limestone products would be transported by truck to markets primarily in ...

Oct 03, 2017· Miners operating in Indonesia will have to pay a share of their after-tax profits to both the central and local governments under new tax rules under consideration for next year, according to ...

Circular For Rate Of Royalty For Mining Limestone-India ... indonesia mining royalty rate. ... circular for rate of royalty for mining limestone. reptilian beings range from five and a .

The current royalty rates are listed below. For any mineral not listed below (that is, a mineral for which there is no specified rate in the Mineral Resources Regulation), the rate is 2.5% of the value and the royalty-free threshold applies. The value of a mineral (other than coal seam gas) is calculated by determining the gross value of the ...

2.1 Government Tax Revenues as a Function of the Tax Rate 8 2.2 Ricardian Rent Varies with Land Fertility 22 2.3 Sources of Rent for Mine B 25 2.4 User Costs in the Mining Industry 28 3.1 Effective Tax Rate vs. per Capita GDP for 24 International Mining Jurisdictions 119 3.2 Effective Tax Rate vs. Contribution of Mining to

In the 2012–13 State Budget, the Western Australian Government announced a Mineral Royalty Rate Analysis to review Western Australia's royalty arrangements. This review was conducted jointly by the Department of State Development and DMP, and the final report was released to .

SOUTH AFRICA - MINING AND PETROLEUM ROYALTIES - THE IMPOSITION AND CALCULATION By BETSIE STRYDOM (Director in the Tax Practice of the Corporate Department of BOWMAN GILFILLAN) The imposition of mineral and petroleum royalties ("mining royalties") in South Africa commenced on 1 March 2010 1 The Mineral and Petroleum Resources Royalty Act 28 ...

Nov 19, 2002· Can anyone out there in the great Google family of researchers tell me what is the competitive rate that a quarry mining operation (limestone) should pay (on a per ton or percentage basis) to the owners of the land upon which the rock is mined? The quarry is located in Kentucky and is mined year round.

spesifikasi teknis limestone crushing di indonesia. rate of royalty on mining of limestone in indonesia limestone quarry crushing plant, spesifikasi teknis limestone crushing di indonesia harga hammer mill sni. Get Info spesifikasi stone milling - chanchalcollegeadmissionin. Chat Now national average for royalty from mining stone Traduire ...

WhatsApp)

WhatsApp)